Energy Tax Credits 2023 for Home Improvement Projects

Sharing your quote takes less than a minute

Are you considering upgrading your aging heating and cooling system with a more energy-efficient model? Now might be the perfect time. Thanks to the Inflation Reduction Act of 2022, homeowners can qualify for significant tax credits and rebates worth potentially thousands of dollars when they install qualified heating and cooling systems.

Let’s dive into the credits gained from purchasing and installing energy-efficient heating and cooling equipment.

What Is the Inflation Reduction Act?

Upgrading your home or property with energy-efficient appliances, including HVAC systems, comes with a number of tax credits. The Inflation Reduction Act, signed by President Biden in August 2022, notably expanded or extended the available tax credits for taxpayers that were previously available under the Energy Policy Act of 2005. The new tax credits went into place on Jan. 1, 2023 and run through 2032.

Inflation Reduction Act tax credits are benefits from the government when taxpayers make energy-efficient upgrades to their property. These improvements may include installing solar panels, heat pumps, windows, or insulation, among many others. Taxpayers don’t get an immediate discount on purchasing green-energy items, but they may be eligible for a tax credit when they file their taxes.

Keep reading to learn more about the tax credits available for the purchase and installation of energy-efficient heating and cooling systems.

Air Source Heat Pumps Tax Credit

In recent years, the popularity of air source heat pumps has steadily increased. These energy-efficient and environmentally friendly alternatives to traditional heating and cooling systems have gained significant traction. Heat pumps differ from furnaces and boilers in that they don’t burn fuel to generate heat. Instead, they extract heat from outdoors and transfer it to the inside of homes during the colder months.

Because of their lower carbon footprint, heat pumps come with the largest tax incentives among qualifying HVAC equipment. For air source heat pumps purchased and installed between January 1, 2023, and December 31, 2032, the tax credit is 30% of the total project cost, up to $2,000. The equipment must meet the required standards.

Energy Star-certified heat pumps purchased and installed on a primary residence before December 31, 2022, are eligible for an energy tax credit of 10% of the cost (up to $500) or a specific amount from $50 to $300.

Energy-efficiency requirements apply to split and packaged systems. This credit is effective only if the heat pump began servicing an existing home that serves at the homeowner’s primary residence. New construction and rentals do not apply.

Geothermal Heat Pumps

Geothermal heat pumps, also referred to as ground source heat pumps, are the most energy-efficient HVAC system on the market. A geothermal heat pump transfers heat between your home and underground depending on the season. Because the installation process is lengthy and involves burying a series of pipes called the ground loop underground, geothermal heat pumps are more expensive, ranging in price from about $10,000 to $30,000 or more.

However, through the Inflation Reduction Act of 2022, homeowners who install Energy Star-qualified geothermal heating and cooling systems are eligible for 30% off the cost of buying and installing the system through available tax deductions.

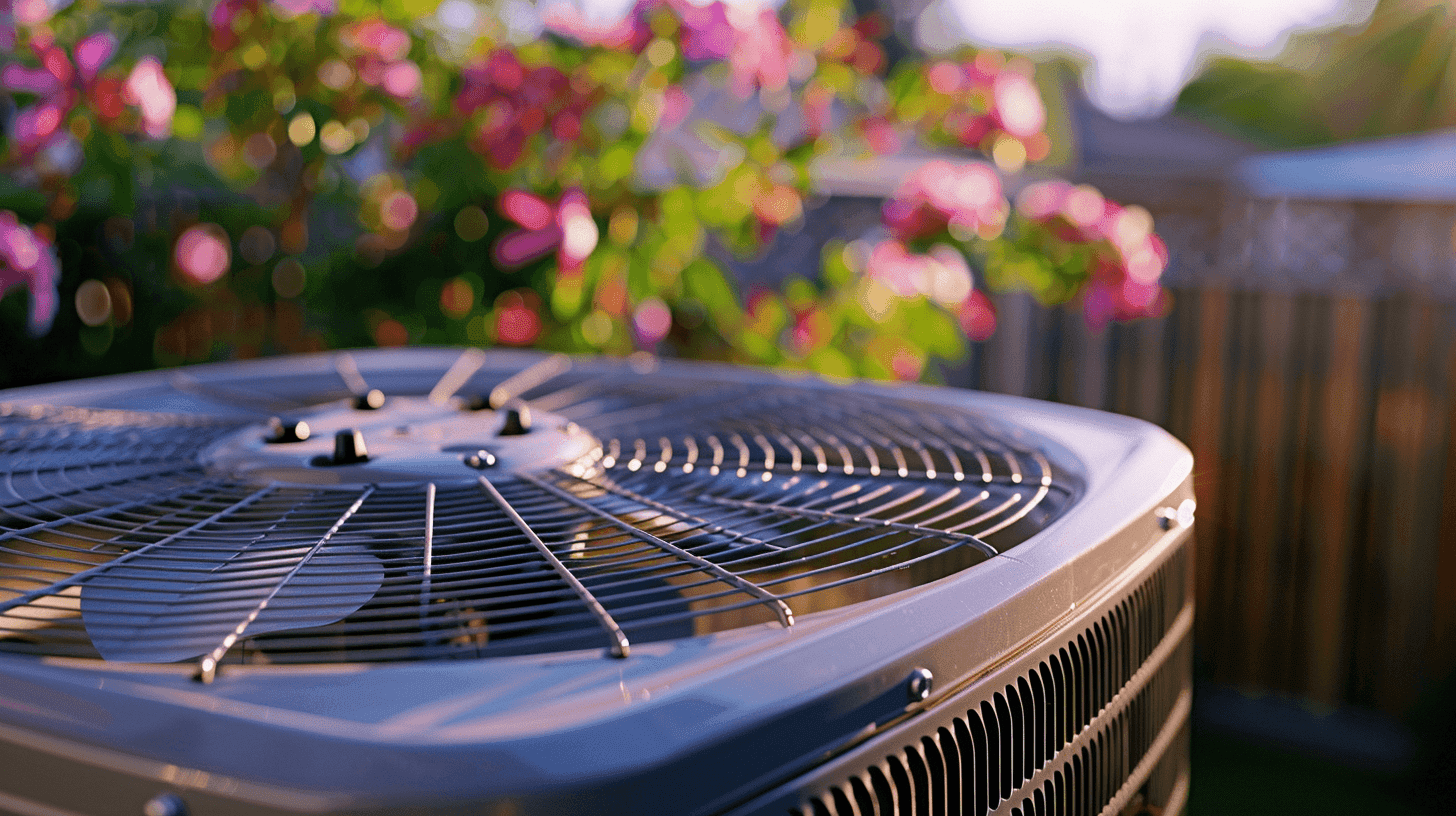

Central Air Conditioners Tax Credit

For qualifying central air conditioners installed in your primary residence between January 1, 2023, and December 31, 2032, you can claim a tax credit of 30% of the total project with a max benefit of $600. New-construction homes and rentals are not eligible for this home tax credit.

Energy Star defines eligible products as split systems with SEER2 > 16 that are Energy Star certified. All Energy Star-certified packaged systems are eligible.

The Nonbusiness Energy Property Tax Credit, now called the Energy Efficient Home Improvement Credit, may apply to central air conditioning units installed through the end of 2022. The maximum tax credit amount is $300 for qualifying units installed through December 31, 2022. To verify tax credit eligibility, ask your HVAC contractor to provide the Manufacturer’s Certification Statement for the purchased equipment.

Oil, Natural Gas, and Propane Furnaces and Boilers Tax Credits

You can also claim an energy tax credit for oil, natural gas, and propane furnaces, as well as boilers, installed between January 1, 2023, and December 31, 2032. Qualifying units are eligible for up to 30% of the project cost, not to exceed $600 max credit. ENERGY STAR-certified gas furnaces with AFUE > 97% are eligible.

Oil and gas furnaces that are Energy Star certified and installed into your primary residence on or before December 31, 2022, may qualify for a $150 tax credit. Furnaces installed in the U.S. South, new-construction homes, or units installed in rental properties do not qualify.

Energy Tax Credit 2023 Limits

The total limit for an efficiency tax credit in one year is $3,200. The limit includes a maximum credit of $1,200 for any combination of home energy improvements (windows/doors/skylights, insulation, electrical) plus furnaces, boilers, and central air conditioners.

The remaining $2,000 credit is available with any combination of heat pumps, heat pump water heaters, and biomass stoves/boilers.

Geothermal heat pump tax credits do not apply toward the limit of $3,200. Energy Star defines the tax credits allowed for geothermal heat pumps.

Tax Credits for Home Builders and Commercial Buildings

Home builders and commercial building owners can also reap significant benefits with the Inflation Reduction Act of 2022.

Tax credits for home builders were extended through 2032. Home builders can receive $2,500 for meeting the most recent Energy Star Manufactured New Homes program requirements. Meanwhile, $500 is available for builders who meet the Energy Star Multifamily New Construction National program requirements.

Commercial building owners can also take advantage of expanded and extended tax deductions. To qualify, buildings must improve their energy efficiency by at least 25%.

HVAC.com Can Help You Buy With Confidence

Worried about overpaying for your next HVAC project? HVAC.com delivers comprehensive HVAC quotes within 24 hours, giving you peace of mind to move forward with confidence. Utilizing data from thousands of HVAC quotes, we’ve established fair pricing to save you time, money, and frustration.

FAQs on 2023 Energy Tax Credits for HVAC Systems

What HVAC systems qualify for the Inflation Reduction Act?

Homeowners who purchase air source and geothermal heat pumps; central air conditioners; boilers; and natural gas, oil, and propane furnaces are eligible for tax credits.

What does the Inflation Reduction Act do for heat pumps?

Homeowners who install an energy-efficient air source heat pump can claim a tax credit that covers 30% of the project’s total cost, up to $2,000. For geothermal heat pumps, homeowners can receive a 30% discount on the cost and installation of the system.

Does inflation reduction act cover air conditioning?

Yes, air conditioners are covered under the Inflation Reduction Act of 2022. Although the incentives aren’t as high for air conditioners compared to heat pumps, homeowners can claim up to a 30% tax credit for the purchase and installation of a central air conditioning system, up to $600.

Sharing your quote takes less than a minute