HVAC Tax Credits Expiring at the End of 2025

What Homeowners Need to Know to Maximize Savings

If you’ve been putting off replacing your heating or cooling system, here’s your wake-up call: the federal HVAC tax credits expire on December 31, 2025.

When the Inflation Reduction Act (IRA) of 2022 passed, homeowners had until 2032 to take advantage of energy-efficiency tax credits. But in mid-2025, Congress passed legislation which quietly pulled that deadline forward by seven years.

The Energy Efficient Home Improvement Credit (25C) can potentially put hundreds – or even thousands – of dollars back in your pocket, but only if your new system is installed and documented before the end of 2025.

What This Means for Homeowners

Homeowners can receive a credit for 30% of the costs incurred from specific energy-efficient improvements to their homes, with an annual cap of $3,200. This includes upgrades to various HVAC systems such as central air conditioning, heat pumps, furnaces, boilers, and ductless mini-split systems.

We reached out to Catherine Torrance, CPA and Principal Owner of Virginia-based CD Torrance & Associates, to help clarify what homeowners need to know about the credits come tax time.

Torrance explained the basics: to qualify for an HVAC tax credit, your system must be installed in your primary residence (not a rental property, vacation home, or newly built home).

To claim the credit, you’ll file IRS Form 5695 when you do your taxes. A certified public accountant such as Torrance can guide you through the process. If you’re filing taxes online, most tax preparation software includes a section for “Home Energy Credits” under Deductions & Credits. The software will ask a series of questions to fill out the necessary information, which is automatically transferred to IRS Form 5695.

If you have installed qualifying equipment since 2023, and haven't claimed the credit yet, you may still be in luck. You can amend your tax return within three years of filing or two years of paying the tax.

What is a Tax Credit, Exactly?

“A tax credit directly reduces what you owe,” Torrance explained. “If you owe $2,000 and get a $1,000 credit, you only owe $1,000. It puts money back in your pocket.”

In other words, it’s not like a rebate that arrives as a check in the mail. A tax credit is applied against your tax liability, reducing what you owe.

That distinction matters on Tax Day. While your accountant or online tax software can assist, Torrance warned that if you don’t come prepared with the right documentation, you could end up paying extra for unnecessary guidance.

“Claiming these energy tax credits is absolutely worth the effort,” she said. “Even a few hundred or a couple thousand dollars can make a big difference on your tax bill. Taking the time to gather your invoices and efficiency documentation now can really pay off, especially with credits that carry forward.”

What Documentation Do You Need?

Save the following documentation for tax purposes:

- A manufacturer’s certification statement noting it qualifies for the credit.

- An invoice dated by December 31, 2025, showing the equipment was installed by year-end.

- The system’s efficiency ratings (SEER2, EER2, HSPF2, or AFUE) to prove it meets federal requirements.

Although these documents are not required when filing your tax return, they may be necessary if your return is audited, according to the IRS. The IRS advises keeping purchase receipts, installation records, and relevant labels to support your claims in case of an audit.

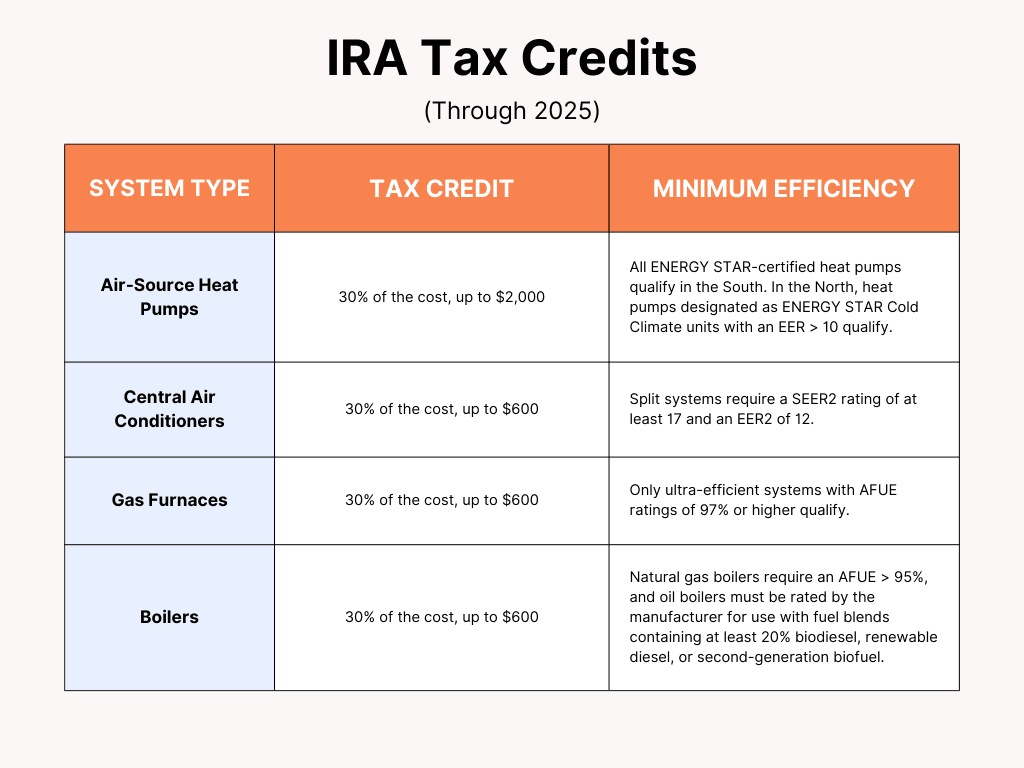

Breaking Down the HVAC Tax Credits

The exact credit amount depends on the type of system you install. Here’s what’s available through the end of 2025:

- Heat Pumps (Air-Source): 30% of the project cost, up to $2,000. All ENERGY STAR-certified heat pumps qualify in the South, while ENERGY STAR Cold Climate units with an EER > 10 qualify in the North. These offer the highest credit potential.

- Central Air Conditioners: 30% of the cost, up to $600. Split systems need a SEER2 rating of at least 17 and EER2 of 12.

- Gas Furnaces: 30% of the cost, up to $600. Only ultra-efficient systems with AFUE ratings of 97% or higher qualify.

- Natural Gas and Oil Boilers: 30% of the cost, up to $600. Natural gas boilers must have an AFUE > 95%, and oil boilers must be rated by the manufacturer for use with fuel blends containing at least 20% biodiesel, renewable diesel, or second-generation biofuel.

- Geothermal Heat pumps: 30% of the cost.

- Electrical Upgrades: If you need to upgrade your panel for a heat pump, you could qualify for an additional $600.

- Other Energy-Saving Improvements: Insulation, windows, exterior doors, and even home energy audits qualify for credits of up to $1,200 a year, separate from the $2,000 heat pump cap.

What Happens After 2025?

Once the credits expire, there’s no guarantee they’ll be extended. Homeowners may still have access to state and utility rebates, especially for lower- and middle-income households. Some manufacturers also offer rebates or 0% APR financing for a limited time.

Why Upgrading Still Makes Sense

Even without credits, upgrading to a high-efficiency HVAC system can make long-term financial sense, although your specific needs and budget should guide your decision-making process.

Some of the benefits include:

- Lower utility bills. A more efficient system uses less energy to heat or cool your home, which directly reduces your monthly bills. Over time, those savings can add up to thousands of dollars.

- Better comfort. Modern HVAC systems run more quietly and maintain more consistent temperatures throughout your home. That means fewer hot and cold spots and a more comfortable living environment.

- Reduced carbon emissions. High-efficiency systems, especially heat pumps, lower your household’s carbon footprint.

- Stronger resale value. Energy-efficient homes are increasingly attractive to buyers, and a new HVAC system can make your home stand out in the crowd. In many cases, you’ll recoup part of the investment when you sell.

The Bottom Line

If you’ve been debating whether to replace your aging and inefficient furnace, air conditioner, or heat pump with a highly efficient system, the next few months may offer the best financial opportunity you'll have for the next decade.

To make sure you qualify:

- Confirm with your contractor that the system meets the federal efficiency standards.

- Get all documentation (invoices, ratings, and certifications) by December 31, 2025.

- File IRS Form 5695 when you do your taxes.

- If you’ve installed a qualifying system since 2023 but haven’t claimed it, talk to your tax professional about amending your returns.